us exit tax rate

Green Card Exit Tax 8 Years. Your average net income tax liability from the past five years is over a set amount 171000 for 2020 You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

Pin By Cha Cha On Real Estate Private Lender Closing Costs Down Payment

An expatriation tax is a tax on someone who renounces their citizenship.

. Anytime a US citizen or long-term permanent resident chooses to leave the US taxation system they must be aware of the tax consequences of doing so especially in light of the US exit tax that was brought into effect in 2008 under the HEART Act. Its the last chance for the CRA to tax the. You will also be taxed on all your deferred compensation.

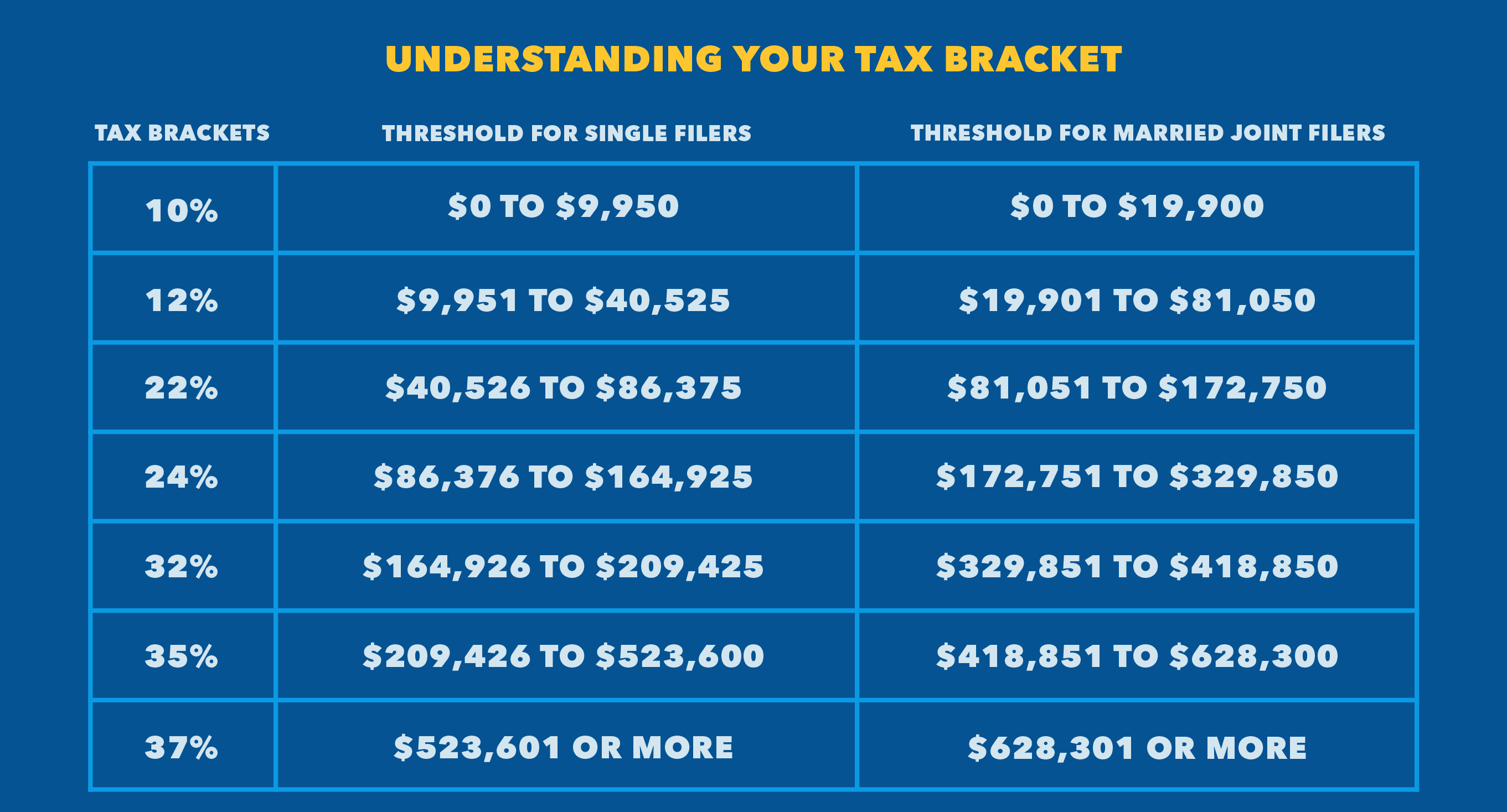

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Federal income tax rates range from 10 percent to 37 percent.

The term expatriate means 1 any US. 1 737 205 6687. Legal Permanent Residents is complex.

By contacting a tax accountant they can estimate the amount that you would have to pay in exit tax. The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as. Citizen who relinquishes his or her citizenship and 2 any long-term resident of the United States who ceases to be a lawful permanent resident of the United States Sec.

The general proposition is that when a US. It rises to 12200 for 2019 and 12400 for 2020. The percentage of exit tax is different for everyone as it is based on your marginal tax rates.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. Level 17 31 Queen Street.

Once you have paid the exit tax either in a giant lump sum up front or because of the 30 withholding made on payments as you receive them you have cash in your pocket. The IRS will not tax you a second time. The tax authorities treat this final tax return much like they would treat the tax return of a deceased person says Poitras.

Exit Tax Consists of Several Things. The phrase exit tax that we use consists of four different ways in which. If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the.

The IRS Green Card Exit Tax 8 Years rules involving US. The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation. 877Ag2A long-term resident is an individual who is a lawful permanent resident ie a green card holder of the United States.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Since it will include your departure date the change will be confirmed when you file a final tax return by April 30 of the year following the one you left Canada. The Foreign Earned Income Exclusion threshold for 2018 was 103900.

Has imposed its own exit tax. You are free to move about the planet. The Child Tax Credit remains 2000 for all three years with the refundable part that many expat parents can claim as a payment also staying the same at 1400 per child.

As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be any higher than 238. In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal. Exit tax applies to United States expatriates.

Any gifts or bequests that you make as a covered expatriate to a US. The mark-to-market tax does not apply to the following. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to. Exit Tax and Expatriation involve certain key issues.

In 2017 that threshold was 162000 per year. The total amount of the gift is reduced by the annual gift exclusion 13000 in 2011 and then subject to the highest marginal. Eligible deferred compensation items.

For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000. Relinquishing a Green Card. Expatriation tax applies to a person described as a covered individual who is taxed on the date of expatriation of US.

If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation. Since 2008 the US. Ineligible deferred compensation items.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. United States of America Tel. Citizen will be subject to provisions of the exit tax.

Green Card Exit Tax 8 Years Tax Implications at Surrender. Citizen renounces citizenship and relinquishes their US. For the purposes of this publication the host countryjurisdiction refers to the countryjurisdiction to which the employee is assigned.

And 2 the deemed distribution of IRAs 529 plans and health savings accounts taxed at ordinary income rates. It rises to 105900 for 2019 and 107600 for 2020. The official United States currency is the United States Dollar USD.

The Basics of Expatriation Tax Planning. It kicks in when individual net worth tops 2 million or when average annual income tax exceeds 165000 for five years. Currently net capital gains can be taxed as high as 238 including the net.

Tax liability another way to trigger the tax is to have a high net income during the five years leading up to losing your status.

House Selling For Dummies Real Estate Fsbo Contract Closing Costs Tax Mortgage Selling House Things To Sell Writing A Book

We Have Awesome Agents In All Of Exit Realty Corp International We Are 11 Top Sides And 20 In Top Gross Closed Commissions Exit Realty Florida Home Realty

Equipment Refinancing Cash Flow Equity Generation

Freebie Resources To Help You Teach Your Lesson On Operations With Complex Numbers Free Worksheet Gu Complex Numbers High School Math Geometry Lesson Plans

A Uk Company Is A Good Solution For Digital Nomads Tax Consulting Uk Companies Corporate Tax Rate

How Your Wealth Is Being Stolen In 2022 Boost Credit Score Ways To Save Money Make More Money

Enjoy With Joury Travels The Holidays Special Offers Call 974 4444 2544 Or Email Info Jourytravels Com Stay The Night Hotels And Resorts Holiday Specials

2013 Peru Itinerary Countryholidays 12 Country Holiday Brochure The Unit

Lifecycle Of A Family Business Take Time To Map It Out More In Our Tax And Wealthmanagement Guide Http Pwc To Writing Planning Wealth Management Business

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

Exit Fees When Leaving A Country Travel Exit Air Travel

What Is A Tax Bracket The Turbotax Blog

The Dominoes Effect Dominoes Economic Stimulus Meme Memes My Stimulus Check Payment Status Not Available Pizza Tracker Public Meme Memes Domino Effect Messages

With The Us Stock Markets Falling Sharply Since The Elections Shell Shocked Investors Are Scrambling For The Exits And Us Stock Market Stock Market Election

Investing Archives Napkin Finance Investing Personal Finance Budget Finance Investing